Global automotive growth is set to outpace the progress of established markets. Currently accounting for nearly 60 percent of total automotive profit, emerging markets are projected to grow at more than three times the rate of the established markets. By 2020, emerging markets will account for two-thirds of all automotive profit. China is the driving force behind this transformation. The following are six trends that are likely to shape the global automotive market in the next few years. This is a good time to invest in global automotive research and development.

Market structure

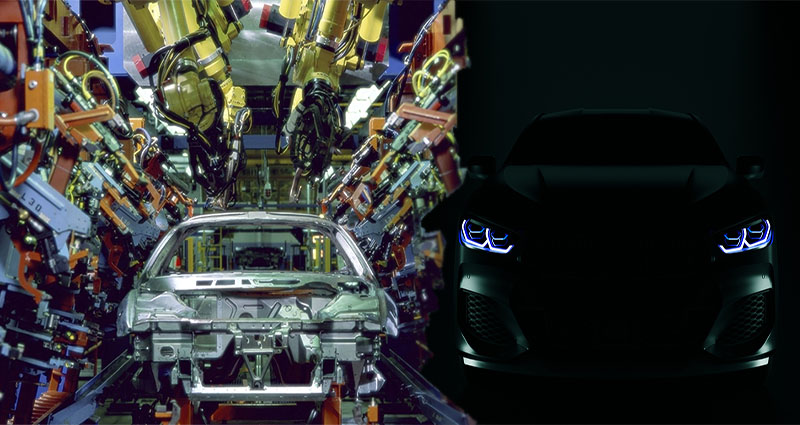

Globalization has accelerated the process of globalization in the automotive industry, leading to more complex production networks and value creation structures. In addition to the complexity of supply chains, some vehicle models are produced at one location and sold throughout the world. However, demand structures have changed enormously in recent years. For example, Asian demand for large SUVs has increased significantly, but North American production capacities have remained the same. This means that there is less room for differentiation among premium OEMs.

Innovations

The automobile has evolved from simply being a mode of transport to a sophisticated device that caters to a plethora of consumer needs. Automobiles can now sense road rage and react with a “Mood Burst,” while improving fuel efficiency and passenger safety are just as pressing issues. Ultimately, the automobile must be sustainable, and the innovation industry must adapt. But what does the future hold for the automotive industry?

Cost pressures

In the past, economies of scale were linked to individual models. A producer needed to produce 250,000 units per year to break even. However, today these economies of scale are tied to underlying platforms, shared modules, and components. While economies of scale create opportunities to spread costs across models, they also create risks for the entire range of models if a critical component fails. To overcome these risks, OEMs should adopt new strategies for cost recovery.

Regionalization

The global automotive industry is undergoing massive changes, spurred on by the financial crisis and governmental bailouts. The auto industry’s supply chain is extremely interconnected, putting it at risk of supply shocks, which could cause major financial losses. The automotive industry also relies heavily on Chinese suppliers, as evidenced by the rise of the “Big Three” in the 1990s. Globalisation has resulted in regionalization of business operations, and the future of the industry is likely to unfold within these nested growth poles.

China’s automotive industry

The main players in the automotive industry in China are the SAIC Motor, Chang’an Motors, Changhe, Hafei Motor, BYD Auto, Chery Automobile, and Great Wall Motors. SAIC Motor, one of the traditional “Big Four” state-owned car manufacturers, sells vehicles under the Maxus, MG, Roewe, Baojun, and Tianjin Xiali brands. Some of its other notable products include the Toyota Prius, BMW, and Volkswagen.